Finbots

Finance

Maximize Collections, Minimize Risk with FinbotsAI Collection Scorecard

Average rated: 0.00/5 with 0 ratings

Favorited 0 times

Rate this tool

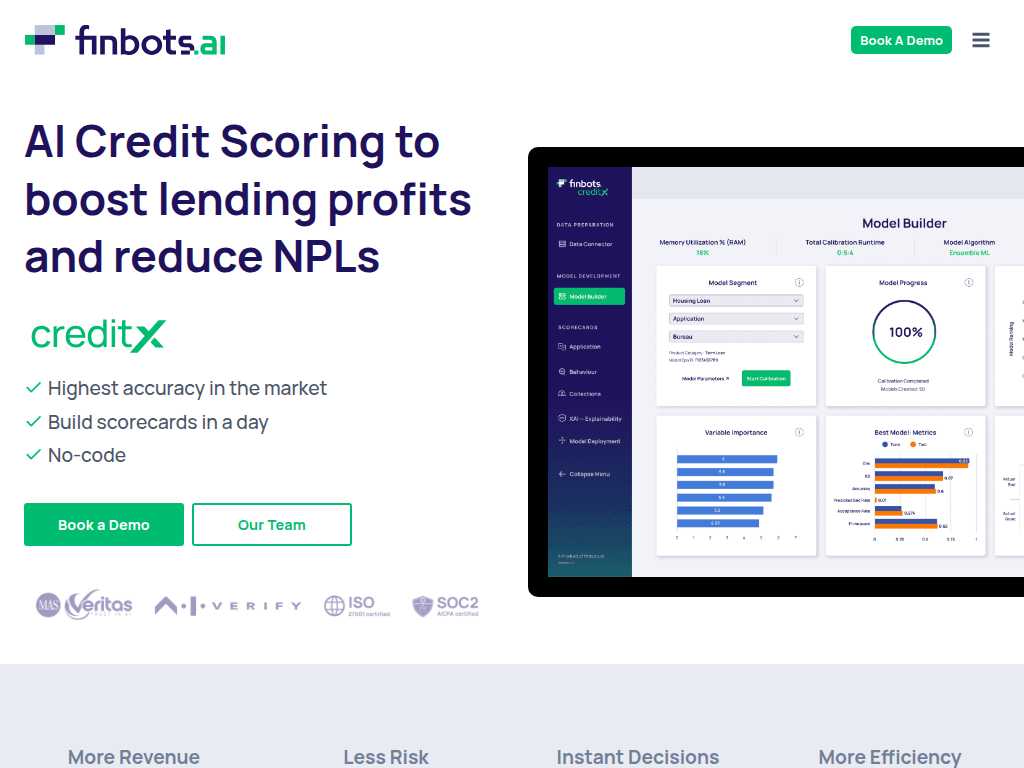

About Finbots

Finbots is an innovative AI-driven financial technology product that revolutionizes the way lending businesses operate. Users benefit from enhanced credit risk management, thanks to highly accurate AI credit scoring that reduces non-performing loans (NPLs) and increases profitability. Additionally, Finbots offers rapid deployment of CreditX scorecards, which can be built in a day with no coding required, providing a fast and efficient solution for modern financial institutions. By integrating seamlessly into existing workflows, Finbots improves operational efficiency, enabling lenders to make instant decisions and significantly reduce operating costs by over 50%. This cutting-edge solution not only streamlines processes but also delivers data-driven insights through fully explainable AI, offering deeper assurance for every decision.

Key Features

- Accurate Predictions

- Boost Debt Collection Rates

- Predict Write-off Risks

- Rapid Model Deployment

- Seamless Workflow Integration

- Fully Explainable AI

- Data-based Recommendations

- Early Severe Case Detection

- Faster Collections

- Higher Recovery Rates